Replication Exercise#

In this exercise we show the validity of the package in replicating Phillips et al. (2015).

We download the CAPE data from the Shiller website to perform the exercise.

[1]:

import pandas as pd

url: str = (

"https://img1.wsimg.com/blobby/go/e5e77e0b-59d1-44d9-ab25-4763ac982e53/downloads/02d69a38-97f2-45f8-941d-4e4c5b50dea7/ie_data.xls?ver=1743773003799"

)

data: pd.DataFrame = (

pd.read_excel(

url,

sheet_name="Data",

skiprows=7,

usecols=["Date", "P", "D", "E", "CAPE"],

skipfooter=1,

dtype={"Date": str, "P": float},

)

.rename(

{

"P": "sp500",

"CAPE": "cape",

"Date": "date",

"D": "dividends",

"E": "earnings",

},

axis=1,

)

.assign(

date=lambda x: pd.to_datetime(x["date"].str.ljust(7, "0"), format="%Y.%m"),

)

.set_index("date", drop=True)

)

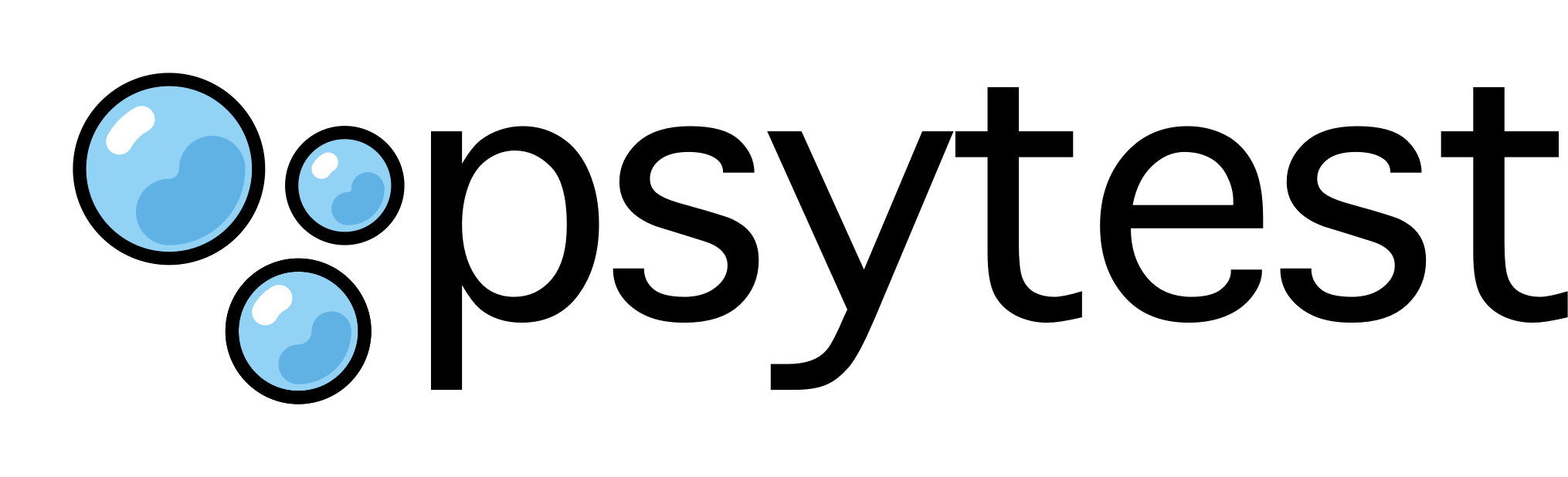

We look for the existence of bubbles in the Price-Dividend ratio.

[2]:

pdratio: pd.Series = data["sp500"] / data["dividends"]

pdratio = pdratio.dropna()

[3]:

import matplotlib.pyplot as plt

import seaborn as sns

sns.set_theme(

context="notebook",

style="whitegrid",

font_scale=1.5,

rc={"figure.figsize": (12, 6)},

)

plt.plot(pdratio)

plt.title("Historic P/D Ratio")

plt.show()

Using the psytest package, we first initialize the object using the PSYBubbles function.

[4]:

from psytest import PSYBubbles

from numpy import datetime64

psy: PSYBubbles[datetime64] = PSYBubbles.from_pandas(

data=pdratio, minwindow=None, lagmax=0, minlength=None

)

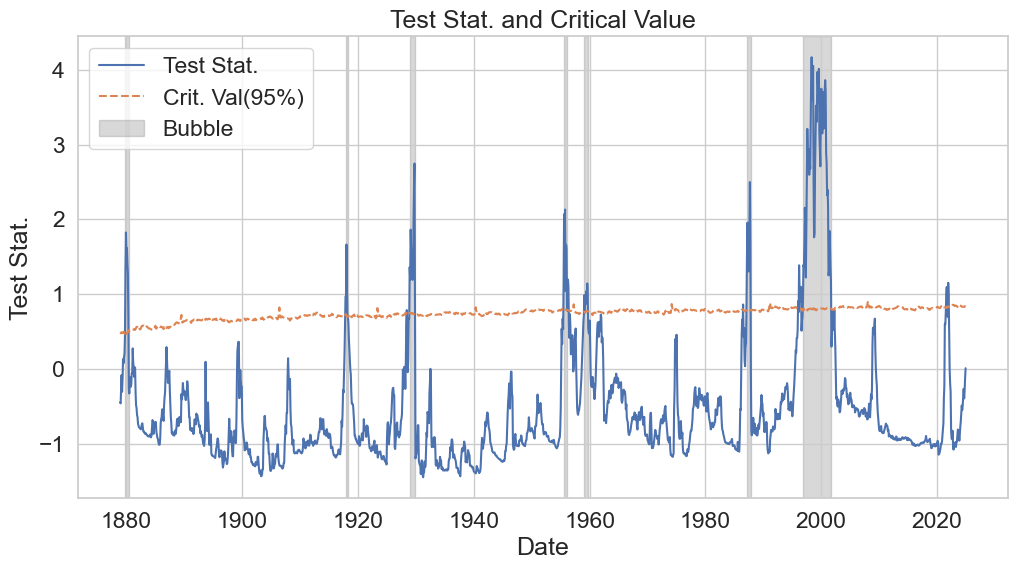

Then we calculate the test statistics and critical values. We will be using a significance level of 5% using the available tabulated data by setting fast=True.

[5]:

stat: dict[datetime64, float] = psy.teststat()

cval: dict[datetime64, float] = psy.critval(alpha=0.05, fast=True)

Using these objects, we find the occurances of bubbles in the data:

[6]:

bubbles: list[tuple[datetime64, datetime64 | None]] = psy.find_bubbles(alpha=0.05)

[7]:

plt.plot(stat.keys(), stat.values(), label="Test Stat.")

plt.plot(cval.keys(), cval.values(), linestyle="--", label="Crit. Val(95%)")

for i, bubble in enumerate(bubbles):

plt.axvspan(

bubble[0],

bubble[1] if bubble[1] is not None else pdratio.index[-1],

color="gray",

alpha=0.3,

zorder=-1,

label="Bubble" if i == 0 else None,

)

plt.legend()

plt.title("Test Stat. and Critical Value")

plt.xlabel("Date")

plt.ylabel("Test Stat.")

plt.show()

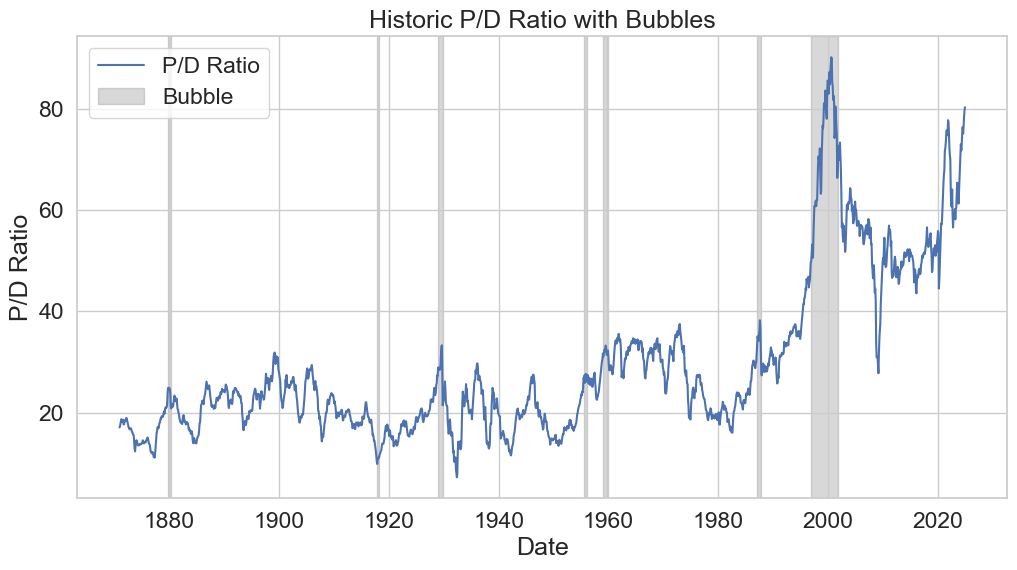

[8]:

plt.plot(pdratio, label="P/D Ratio")

for i, bubble in enumerate(bubbles):

plt.axvspan(

bubble[0],

bubble[1] if bubble[1] is not None else pdratio.index[-1],

color="gray",

alpha=0.3,

zorder=-1,

label="Bubble" if i == 0 else None,

)

plt.legend()

plt.title("Historic P/D Ratio with Bubbles")

plt.xlabel("Date")

plt.ylabel("P/D Ratio")

plt.show()

[9]:

bubbles_table: pd.DataFrame = pd.DataFrame(bubbles, columns=["start", "end"]).assign(

duration=lambda x: x["end"] - x["start"],

)

bubbles_table

[9]:

| start | end | duration | |

|---|---|---|---|

| 0 | 1879-11-01 | 1880-06-01 | 213 days |

| 1 | 1917-11-01 | 1918-05-01 | 181 days |

| 2 | 1929-01-01 | 1929-11-01 | 304 days |

| 3 | 1955-07-01 | 1956-03-01 | 244 days |

| 4 | 1959-02-01 | 1959-10-01 | 242 days |

| 5 | 1987-02-01 | 1987-11-01 | 273 days |

| 6 | 1996-11-01 | 2001-10-01 | 1795 days |

Which match with the ones on the original paper (p.p. 1066).